About Little Explorers Childcare in Worongary

Welcome to Little Explorers Childcare Centre, which is located opposite Worongary State Primary School in Worongary on the Gold Coast Queensland.

Since 1996, Little Explorers Childcare Centre, has been delivering quality care and education to families on the Gold Coast. Read more.

Service details

61-65 Explorers Way,

Worongary QLD 4213

Ph. (07) 5574 9744

littleexplorers@sparrow.edu.au

Monday to Friday

6:30am to 6:30pm

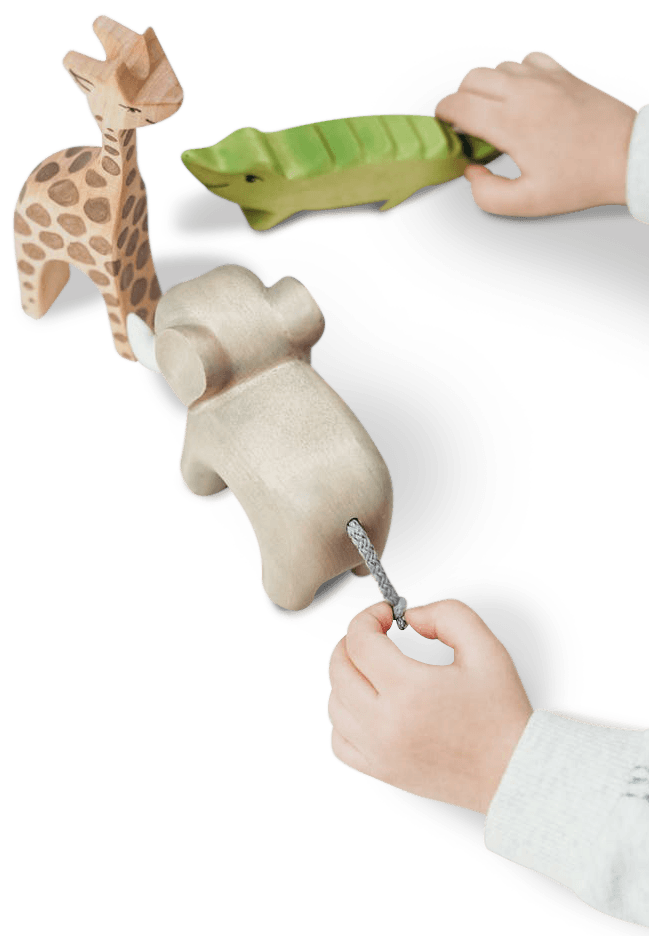

What makes our childcare service in Worongary unique?

- Brand new eco-designed outdoor play spaces

- Wipes & sunscreen provided

- Incursions & local community excursions

- Fully accredited, Government-funded Kindergarten Program

- Highly qualified & experienced educators

- Learning & development updates on your child’s activities

- Meeting National Quality Standards

6 weeks - 15 months

15 months - 24 months

24 months - 3 years

3 years - 3 1/2 years

3 1/2 years - 5 years

Meet

Karen & Lauren

Service Managers at our Childcare Centre, Worongary

“I have been an Early Childhood Teacher in Schools and in Long Day Care for 35 years and have always been passionate about helping children reach their full potential. At Little Explorers we believe that children are encouraged to explore and experiment when provided with a stimulating, warm and caring environment filled with wonder and excitement. Read more.

Ready to get started?

Book a tour to learn more about early learning at Little Explorers Childcare Centre.

The Sparrow Way.

The Sparrow Way combines proven international early learning methods to create a unique practice designed for today’s society. Guided by the principles of Reggio Emilia and underpinned by The Early Years Framework for Australia, we embrace children’s inherent abilities to learn and develop, creating an environment for them to find solutions through exploration, discovery and invention.

Enrolment process

Our childcare centre in Worongary promotes an open-door policy where families can visit and walk through the centre at any time during operational hours.

Once families have completed a tour, they will receive an enrolment pack with all necessary paperwork.

Once enrolled, the orientation process begins. The orientation process is an arrangement made between families and staff that supports the family’s needs.

Accessing the Childcare Subsidy

We understand that access to the Government Childcare Subsidy is an important consideration when choosing a childcare centre. Learn more about eligibility, how to access the subsidy and how Sparrow works with your family to ensure a smooth transition into early learning childcare.

Happy families at Little Explorers Childcare, Worongary

“An amazing centre where the staff and directors really care about your children. They have always been so helpful and informative. My husband and I have been meaning to place a review for awhile so that other parents can get some honest feedback. Your child would be super lucky to attend this Childcare Centre.”

Aleisha Lowe

“Fantastic centre. Love having my kids here, it feels like home. Karen and Toni always have time for us and help out when they can with extra days and all staff are angels with our children.”

Kimberely Hunt

” A beautiful centre that makes you feel like part of their family, not another number. Nothing is ever too much and the quality of care and education is matched only by the passion of all of the wonderful staff. Informative, caring, helpful. Can’t speak highly enough of our experience!”

Young Ones Unleashed

Book your tour today

Book a tour to learn more about Little Explorers Childcare Centre.